If you are a freelancer or independent contractor, the W9 Form 2022 is a standard tax form that needs to be filled out before or after offering services. The purpose of this form is to get your tax information and identity in compliance with the Internal Revenue Service (IRS).

The IRS requires that any individual or business that makes sales of over $600 in a year must have personal data on file, such as an employee’s Social Security number (SSN) or Employer Identification Number (EIN). This can be achieved by filling out an official W9 request for Tax Identification Number and certification form, which will help make sure your company stays compliant with US law while notifying the government of your own personal information.

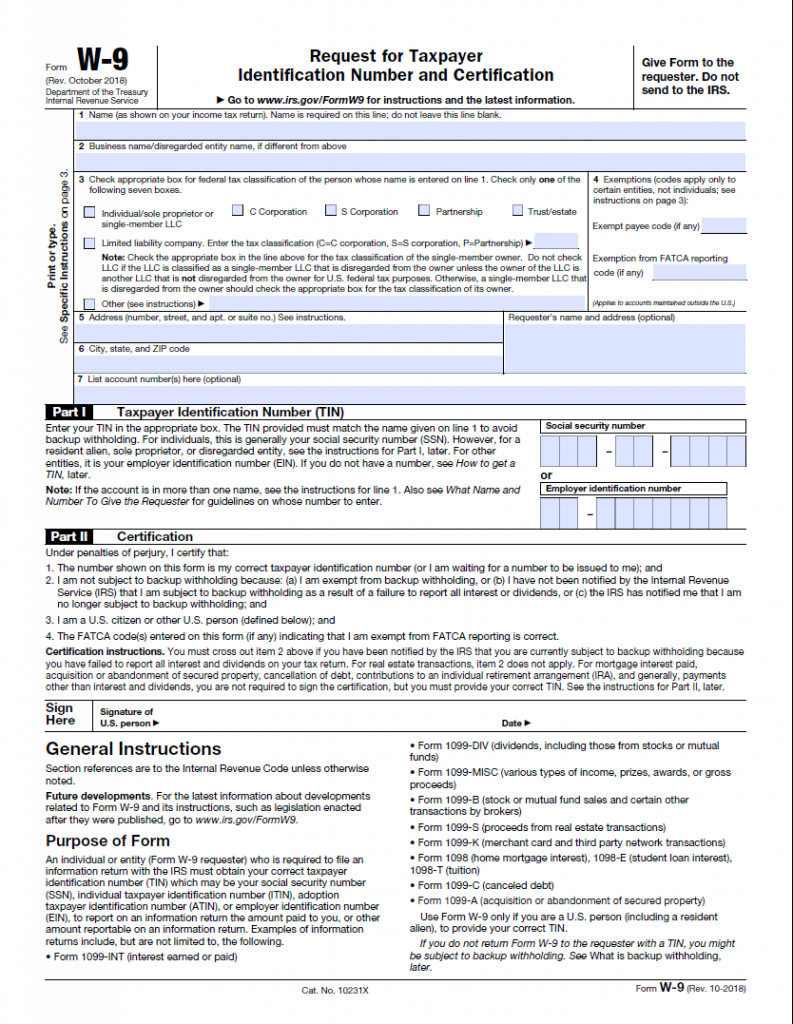

Current Printable W9 Form 2022

A W9 form is a document that businesses use to verify the identity of their financial accounts and employees. This information can be used by other companies to complete transactions, so they must submit their details on the form along with their own. Form W-9 has nine spaces for personal data and 15 lines for business information.

The IRS requires that every company provide an updated copy of this document every year, so it is important for you to fill out this form if you are working as an independent contractor or freelancer. The IRS also requires that your clients provide one if they are paying you more than $600 in any single year through PayPal or other online services. You should not send your W-9 until after a contract has been signed between yourself and another party (or parties). If you do not know who to send it to, then check with them first before filling out your information!

When should you request a W-9 form?

When working with contractors, such as independent contractors, the W9 form must be used. If your organization pays non-employee remuneration or pays small businesses more than $600 each for finished work, the W9 form is necessary.

Independent contractors’ earnings are not subject to withholding or Social Security or Medicare taxes. As a result, the IRS wants to know who is paying so that they can collect. Use the W-9s to keep track of how much you paid each contractor at the end of each tax year. This will make sure that the correct information is given out.

Conclusion

The W9 form is extremely important because it provides information about your business. It is used by the IRS to determine whether or not you are eligible for certain tax deductions and credits. The more complete and accurate this form is filled out, the better off you will be when filing your taxes next year.