The IRS W-9 form is used to request the taxpayer identification number (TIN) of an individual or entity that is being paid certain types of income, such as interest, dividends, or non-employee compensation. The form is typically used by businesses and organizations that make payments to independent contractors, freelancers, or other self-employed individuals.

As a freelancer, you’re probably familiar with the process of filing taxes. But what you may not know is that there is a specific form—the W9 Form 2023 Printable —which is used for tax purposes when you’re paid as an independent contractor.

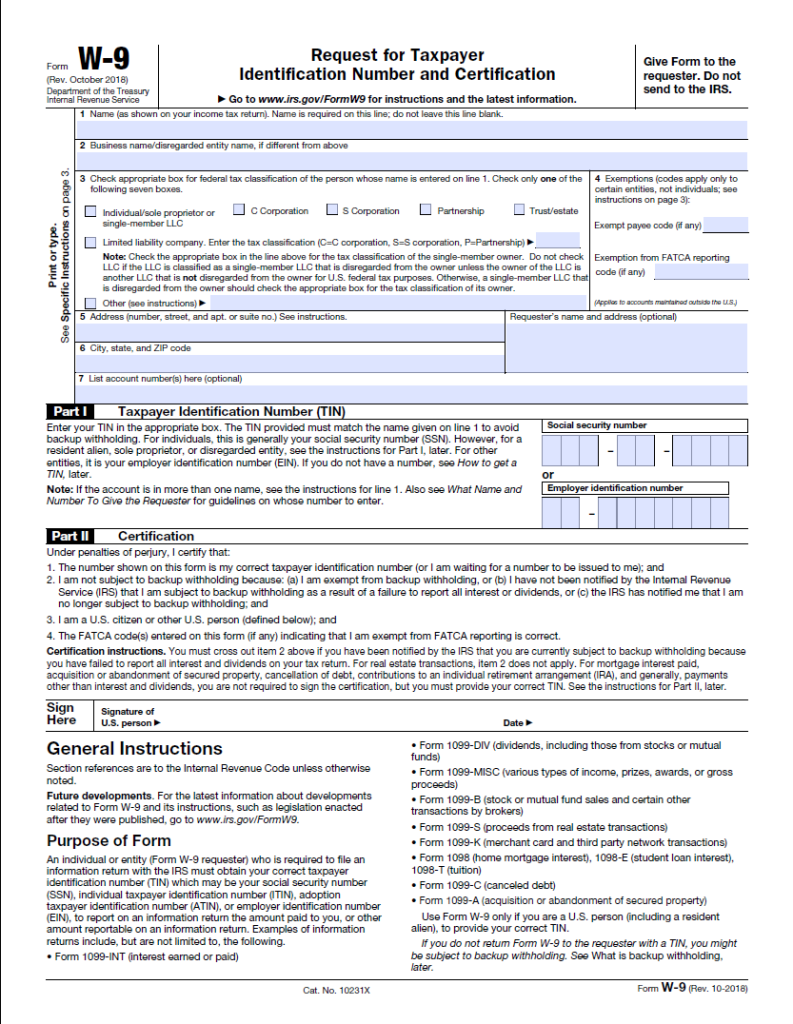

The W-9 form includes information such as the name, address, and TIN of the individual or entity being paid. The person or organization requesting the payment will use this information to prepare and file various tax documents, such as Form 1099-MISC, which reports the income paid to the recipient.

It is important to note that individuals who receive income through self-employment or contract work are responsible for reporting their income on their tax returns, and may be required to make estimated tax payments throughout the year. The W-9 form helps to ensure that the correct TIN is used for tax reporting purposes, and can help to avoid potential issues with the IRS or state tax agencies.

This deadline was April 15th, so if your employer has not submitted their W9 form yet, then they have until June 30th!

The W-9 form is a tax document used in the United States for requesting the taxpayer identification number (TIN) of an individual or entity that is being paid certain types of income, such as interest, dividends, or non-employee compensation. The form is provided by the Internal Revenue Service (IRS) and is typically filled out by independent contractors, freelancers, or other self-employed individuals who receive payments from clients.

The W-9 form includes information such as the name, address, and TIN of the individual or entity being paid. The person or organization requesting the payment will use this information to prepare and file various tax documents, such as Form 1099-MISC, which reports the income paid to the recipient.

The W-9 form can be downloaded and printed from here. It is recommended that individuals keep a copy of the completed W-9 form for their records.

Get Your W-9 Forms 2023 Printable

As a freelancer, it is critical to be aware of the different tax forms that you may need to file. The W9 Form 2023 Printable is one of the most common forms that you will need to fill out. This form provides your Social Security number or taxpayer identification number to the person or company that is paying you. It is important to fill out this form accurately to avoid any problems with your taxes. As a taxpayer, you should keep detailed records of all your W 9 forms. This will help you when it comes time to file your taxes.

The next time you need to fill out any paperwork related to taxes, make sure that they include information about who should be listed as an owner (you) and what type of business entity is being used (LLC or S Corp).

Print W-9 Forms 2023 Printable

Conclusion

- If you are an independent contractor, you may regularly need to fill out a W9 form.

- You can get a copy of your W9 form by visiting the IRS website or from our link provided here.

- The W9 Form 2023 Printable is one of the most common forms that you will need to fill out if you are freelancer or independent contractor.

- As a taxpayer, you should keep detailed records of all your W-9 forms.

- Keeping a copy of W9 form will help you later when it files your taxes.