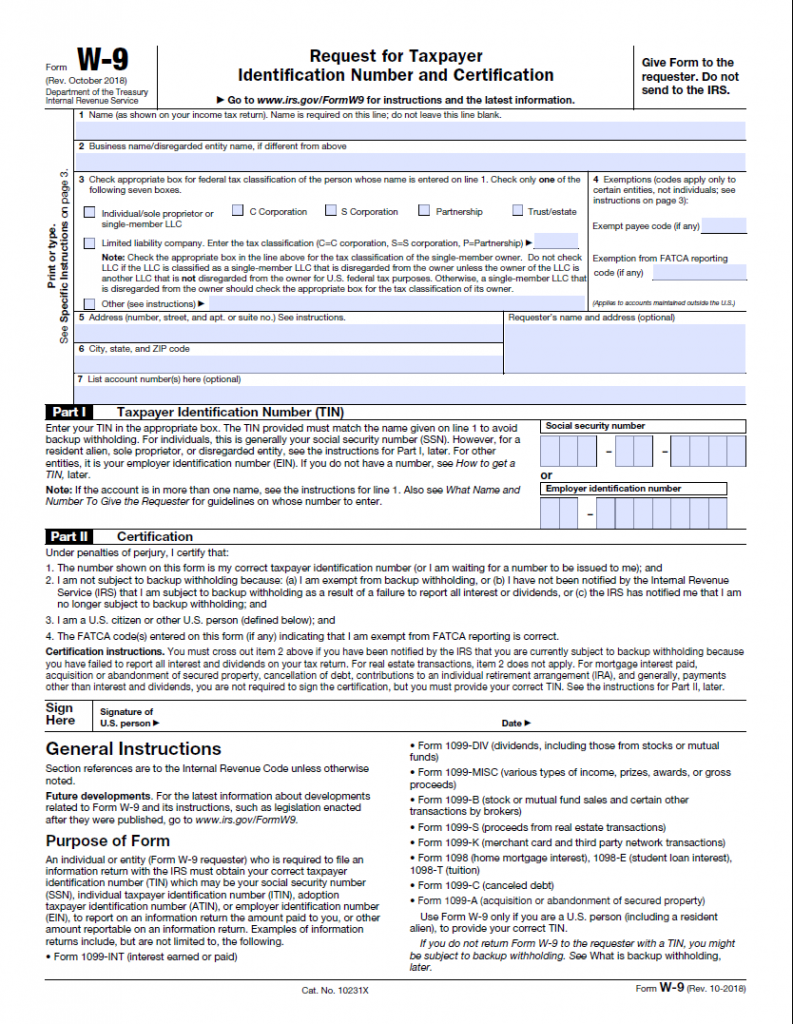

Wisconsin W 9 Form 2022 Printable – Wisconsin’s W-9 form regulation requires companies to report certain information on their customers and vendors. The form collects information on the amount of money a business receives and pays. It can be used by businesses for a variety of different purposes. For example, it can be used by single-member LLCs or limited partnerships. The information included on the form includes the legal name of the company, its address, and an Employee Identification Number (EIN).

Businesses that employ more than one employee must also provide a taxpayer identification number (TIN). This number is similar to a social security number for businesses. It is free to obtain from the IRS and can be obtained over the phone or through the mail. One company wanted to eliminate administrative headaches associated with the W-9 form and implemented an electronic signature process. The result was a reduction of 1,400% in the time needed to get signatures on the form.

When finishing a W-9, you can also include your company’s TIN and SSN. This allows you to keep track of the payments that you’ve made. It’s crucial to bear in mind that a W-9 is not just for company owner but for employees.

Who Requests a W-9 Form?

The W-9 Form must be obtained from you by the person or company who is paying you. The requester is not required to submit the W-9 to the IRS. This individual maintains the form on file and uses the data to generate other returns, including 1099 and 1098 Forms, as well as to determine whether federal tax withholding is required on the payments you receive.

When to ask for a W-9 Form?

For conducting business with independent contractors and freelancers, Form W-9 is necessary. You must obtain a W-9 if your company pays small businesses or independent contractors more than $600 per for work that has been completed.

Wisconsin IRS W 9 Form 2022 Printable is a document that services and individuals need to finish to adhere to the tax law. The form requests information such as account, name, and address number. Those who stop working to comply may undergo a $50 penalty per circumstances. If the noncompliance is not willful, the penalty can be waived.

It is the obligation of the taxpayer to supply the tax agency with precise details. The information you provide will be used by the IRS to gather taxes. In addition, these details may be provided to other government companies, including the Department of Justice. It is complimentary to get a taxpayer identification number, and it can be acquired either through mail or telephone.