Navigating tax season can be daunting, especially for freelancers, independent contractors, and businesses that hire them. One crucial document that simplifies tax reporting for non-employees is the W-9 form. This form collects taxpayer information, ensuring accurate income reporting to the IRS.

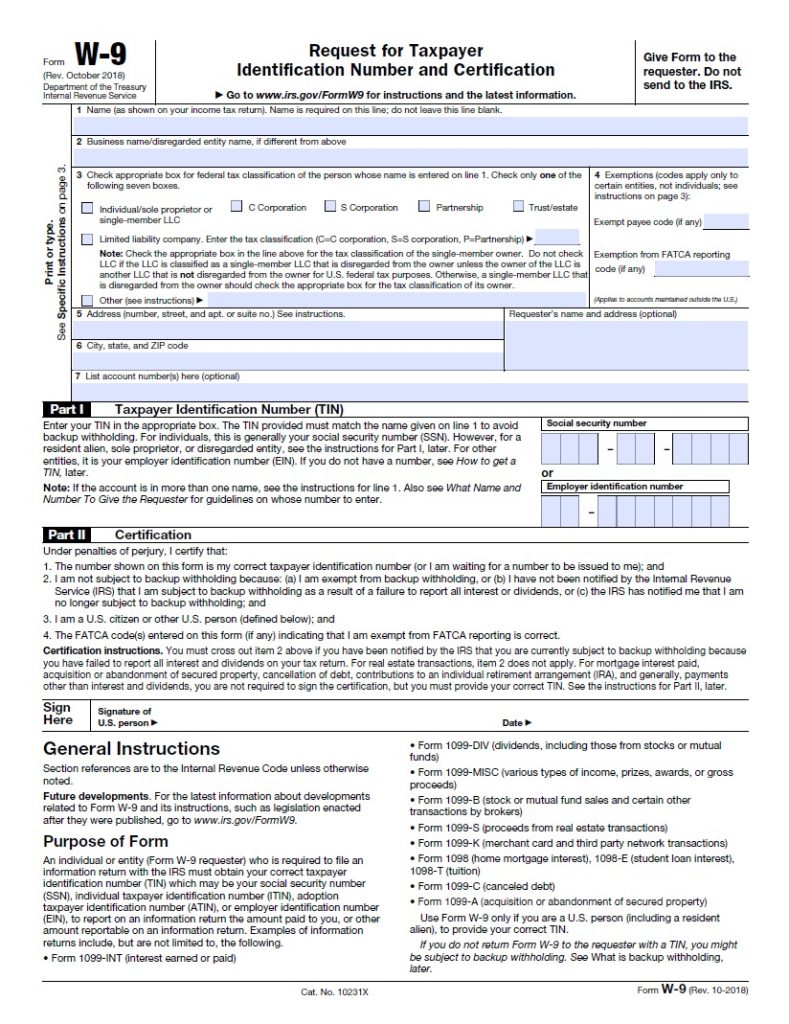

Please, you need to make sure to send the completed form to the employer that requested it, not to the IRS

The W-9 form, officially known as the “Request for Taxpayer Identification Number and Certification,” is used by the IRS to collect accurate tax information from individuals and entities required to file an information return with the IRS. This includes freelancers, independent contractors, and vendors. The information collected via the W-9 form generates 1099 forms, which report the income paid to the recipient.

Why You Might Need a W-9 Form

Businesses and clients request a W-9 form from individuals and entities for several reasons:

- Independent Contractors: To report payments made for services provided.

- Financial Institutions: To report income such as dividends, interest, and capital gains.

- Real Estate Transactions: To report sale proceeds.

- Legal Settlements: To report settlement payments.

How to Access the 2025 Fillable W-9 Form

To download and fill out the 2024 W-9 Form, you can access it from several reliable sources. The IRS website provides the most official version of the form, which you can download and fill out directly here (IRS.gov).

The most reliable source for the latest W-9 form is the IRS website. Here’s how you can download and fill out the 2024 fillable W-9 form:

- IRS Website: Visit the IRS website to download the official W-9 form. This ensures you are using the most up-to-date version.

- Download from our site here.

Steps to Fill Out the W-9 Form

Filling out the W-9 form is straightforward but requires attention to detail. Here’s a step-by-step guide:

- Name: Enter your full legal name as shown on your tax return.

- Business Name: If applicable, enter your business name or disregarded entity name.

- Tax Classification: Select the appropriate tax classification, such as Individual/Sole Proprietor, C Corporation, S Corporation, Partnership, Trust/Estate, or Limited Liability Company (LLC). If you select LLC, indicate the tax classification (C=C corporation, S=S corporation, P=Partnership).

- Exemptions: If you are exempt from backup withholding, provide the relevant code from the IRS instructions.

- Address: Enter your street address, city, state, and ZIP code.

- Taxpayer Identification Number (TIN): Enter your Social Security Number (SSN) or Employer Identification Number (EIN).

- Certification: Sign and date the form to certify accurate information.

Important Considerations

- Accuracy: Ensure all information is accurate to avoid penalties. Providing false information can result in severe penalties, including fines and backup withholding.

- Electronic Submission: Many businesses accept electronically signed and submitted W-9 forms, simplifying the process

- Timeliness: Submit the W-9 form promptly to avoid payment processing delays and ensure compliance with IRS regulations.

Completing the W-9 form correctly is crucial for freelancers, contractors, and various business entities to ensure they receive payments without complications and remain compliant with IRS regulations. Utilizing the fillable PDF versions available online can make the process easier and more efficient. Refer to the latest guidelines on the IRS website or consult a tax professional if you have any doubts.