If you’re an independent contractor, freelancer, or self-employed professional in the United States, you’re likely familiar with the W-9 form. This important tax document is vital for accurate reporting of income and taxes. In this article, we’ll delve into the details of the 2023 W-9 form, how to download it, and why it’s crucial to your financial records.

Understanding the W-9 Form

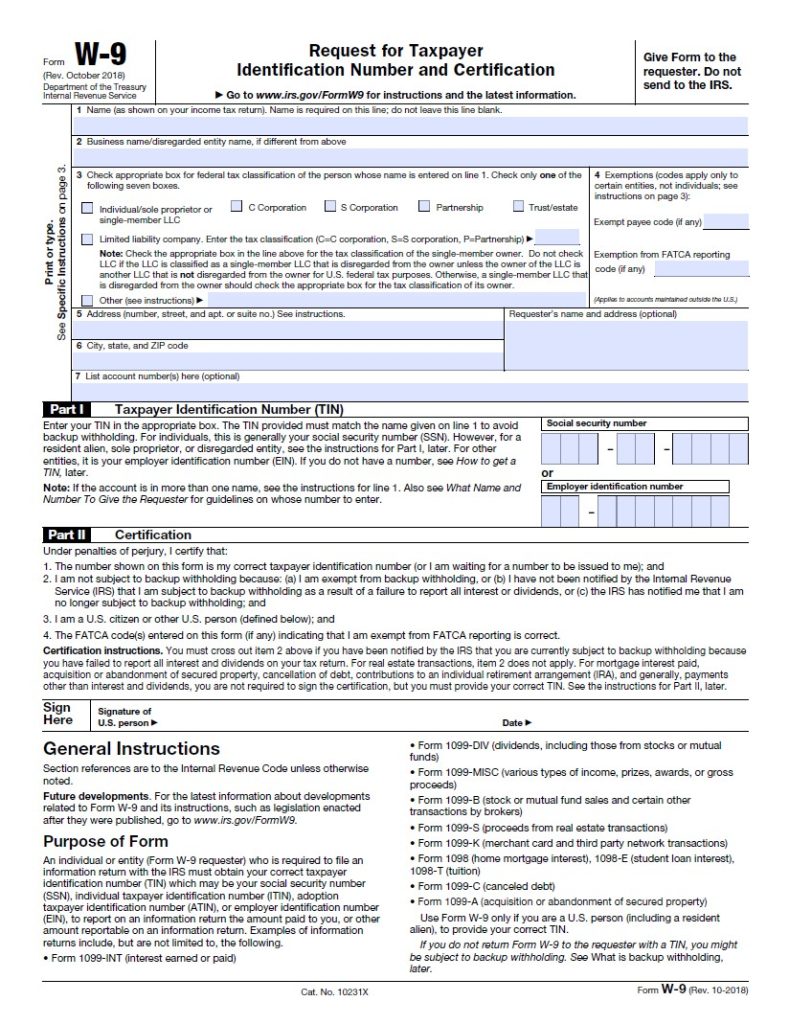

The W-9 form, officially known as the “Request for Taxpayer Identification Number and Certification,” is a document issued by the Internal Revenue Service (IRS). It’s used by businesses to request a taxpayer identification number (TIN) from individuals or entities that they pay for services. This could be an individual’s social security number (SSN) or an employer identification number (EIN) for businesses.

The form provides businesses with the information they need to issue 1099-MISC, 1099-NEC, or other tax documents, which are then used by the contractor or self-employed individual to report their income to the IRS.

W-9 Form 2023 Updates

There haven’t been any changes to the W-9 form for the year 2023. However, it’s always advisable to check the IRS website for the most up-to-date version of the form. Any changes or updates will be reflected on the form available for download on their site.

How to Download the 2023 W-9 Form

Downloading the W-9 form for 2023 is a simple and straightforward process. Follow these steps:

- Visit the official IRS website at www.irs.gov.

- Navigate to the ‘Forms & Instructions’ section.

- In the search bar, type “W-9” and hit enter.

- The most recent version of the W-9 form will appear at the top of the search results. Click on the form link.

- On the form’s page, you’ll see an option to ‘Download’. Click this to begin the download process.

- The W-9 form is available in PDF format, making it easy to save, fill out digitally, or print.

Filling Out the W-9 Form

The W-9 form is relatively straightforward to fill out:

- The top section requires basic information such as your name, business name (if applicable), and your tax classification (e.g., individual, corporation, partnership).

- Next, you’ll be asked for your address and TIN.

- Finally, you will need to sign and date the form, certifying that the information provided is accurate.

Remember to review the form carefully before submitting it. Providing incorrect information on the W-9 form can lead to potential penalties from the IRS.

Importance of the W-9 Form

The W-9 form is a critical piece of documentation for independent contractors and businesses alike. For contractors, it ensures that their income is reported accurately to the IRS. For businesses, it verifies that they’re paying a lawful entity or individual and allows them to correctly report their expenses.

The W-9 form is a key part of tax documentation for the self-employed and businesses. Downloading and correctly filling out the 2023 W-9 form is essential for accurate income reporting and tax compliance. Always remember to check the IRS website for the most up-to-date form and any changes to tax law that may impact you or your business.

As always, if you’re unsure about any part of this process, it’s best to consult with a tax professional to ensure you’re in compliance with all IRS regulations. Always keep a copy: Whether you’re the payer or the payee, always keep a copy of the completed W-9 form for your records. This can be invaluable if there are any discrepancies or audits in the future.