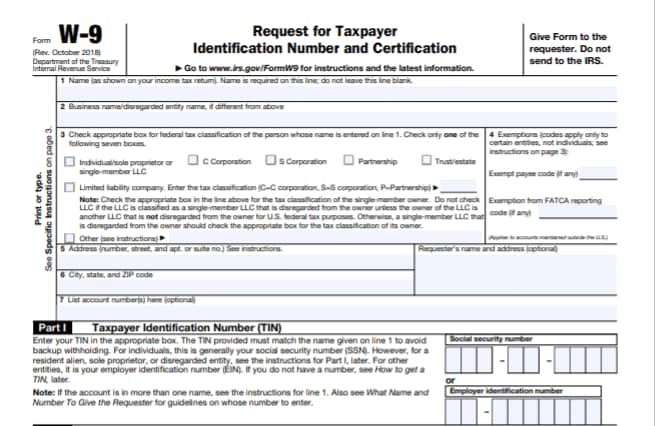

IRS Backup Withholding W9 Form – Form W-9 is used to acquire the correct Taxpayer Identification Number (TIN) of an individual. The form is signed by the taxpayer. It includes sensitive information and must be managed with care. Businesses that pay vendors more than $600 in a fiscal year are required to file a Form W-9. The form is a vital file to make sure that the information on the details return is proper.

You might be able to discover it online if you require a Printable W-9 federal form. You can download the form as a blank template and fill it in by hand or download it as a blank form and print it out.

A lot of companies send a blank form to their new professional or freelancer, however there are numerous places online where you can find the form. The IRS likewise uses W-9 form downloads. You can even get your form by completing an application for a TIN online.

IRS Backup Withholding W9 Form

When finishing a W-9, you can additionally include your employer’s TIN and SSN. This allows you to monitor the payments that you’ve made. It’s essential to keep in mind that a W-9 is not just for business owners but for workers.

Who Requests a W-9 Form?

The W-9 Form must be obtained from you by the person or company who is paying you. The requester is not required to submit the W-9 to the IRS. This individual maintains the form on file and uses the data to generate other returns, including 1099 and 1098 Forms, as well as to determine whether federal tax withholding is required on the payments you receive.

When to ask for a W-9 Form?

For conducting business with independent contractors and freelancers, Form W-9 is necessary. If your company pays small businesses or independent contractors more than $600 per for work that has been completed, you must obtain a W-9.

IRS w9 federal form 2022 is a document that services and professionals should complete to comply with the tax law. The form requests information such as name, address, and account number. Those who stop working to comply might be subject to a $50 penalty per instance. If the noncompliance is not willful, the charge can be waived.

It is the duty of the taxpayer to provide the tax firm with accurate information. The information you supply will be utilized by the IRS to collect taxes. In addition, this details might be supplied to other federal government firms, including the Department of Justice. It is totally free to obtain a taxpayer identification number, and it can be gotten either through mail or telephone.