As a freelancer, keeping track of your financial resources and understanding the importance of tax forms is vital. One such form that is vital for freelancers is the W9 form. This short article will direct you through filling out your fillable W9 form for the year 2023.

A W9 form is a tax document used by freelancers in the United States. The form provides information about the freelancer’s tax identification number (TIN) and the type of TIN used.

Why is a W9 Form Important for Freelancers?

A W9 form is essential for freelancers because it is used to report income to the Internal Revenue Service (IRS). The form is used to notify the freelancer’s payment to the IRS and the client paying the freelancer.

If a client pays a freelancer more than $600, the client must report the income to the IRS using a W9 form. The client will use the information provided on the W9 form to complete a 1099-MISC form, a tax form used to report miscellaneous income.

What is a Fillable W9 Form?

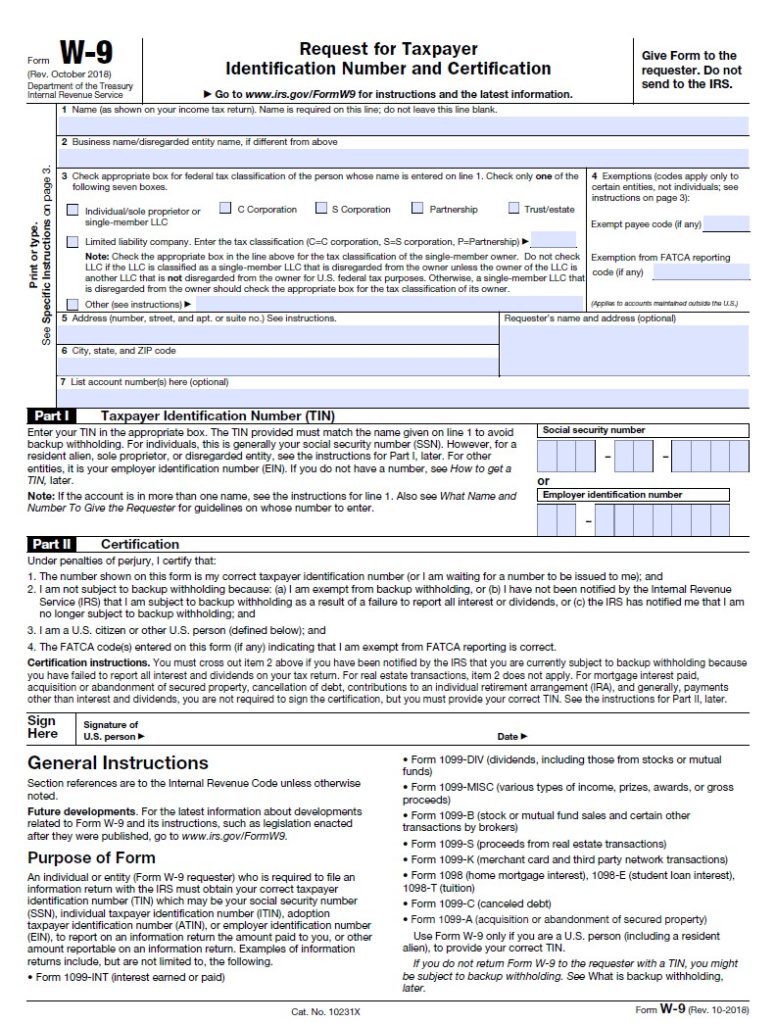

The W9 form, also known as the Request for Taxpayer Identification Number and Certification form, is utilized by services and clients to request the freelancer’s tax identification number (TIN) and other associated information. The fillable W9 form is a digital version that can be finished and sent electronically.

Fillable W9 forms are available online and can be quickly completed by the freelancer. Businesses or clients typically use this form to request the freelancer’s TIN information for tax purposes.

Why is a Fillable W9 Form Important for Freelancers?

A W9 form is necessary for freelancers because it’s used to report their earnings to the Internal Revenue Service (IRS). The client must report the income to the IRS using a W9 form if a freelancer earns more than $600 from a client in a tax year. The details provided on the W9 form are used to finish a 1099-MISC form, a tax return used to report miscellaneous income.

How to Fill Out a Fillable W9 Form

Filling out a fillable W9 form is simple and basic. Here’s a step-by-step guide on how to complete the form:

- Download the fillable W9 form from the IRS website or a dependable online source.

- Enter your legal name, company name (if appropriate), and TIN in the designated areas.

- Select the type of TIN you use (Social Security Number or Employer Identification Number).

- Enter your address and contact number.

- Check the suitable boxes to show your status as a sole proprietor, collaboration, corporation, etc.

- Indicate and date the form.

Please submit the form to the customer who requested it.

The fillable W9 form is a necessary file for freelancers to keep an eye on their financial resources and report their earnings to the IRS. By following the steps detailed in this guide, you’ll have the ability to submit your fillable W9 form for 2023 quickly. Ensure to keep a copy of the form for your records.