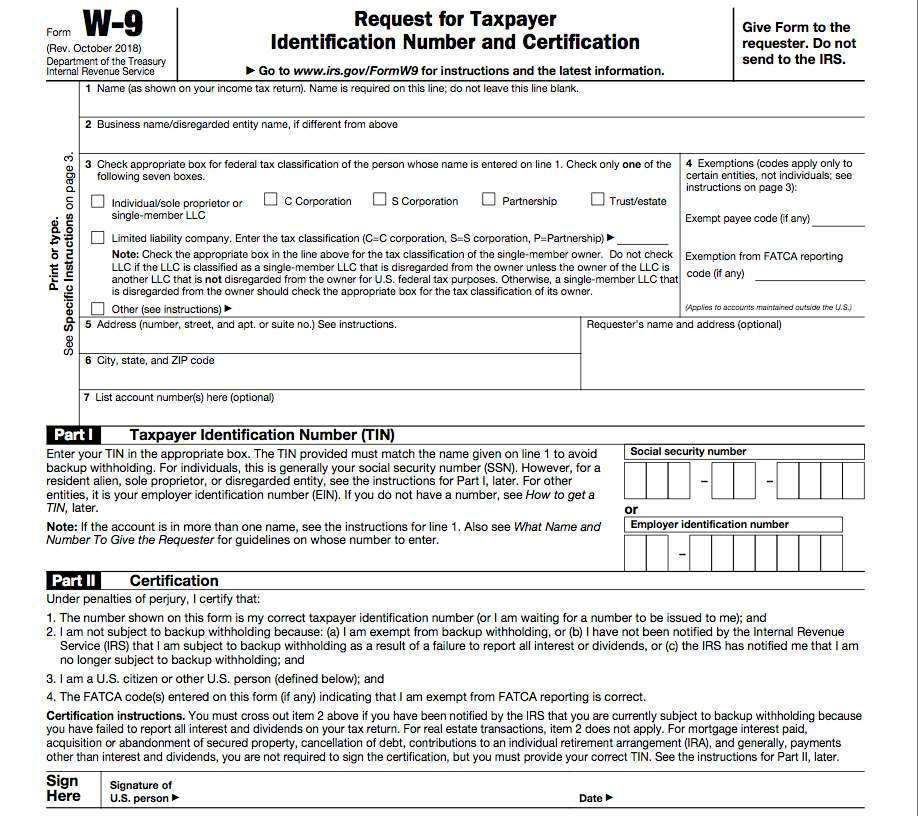

Current W 9 Form Irs –The W-9 form is a tax form that the Irs (INTERNAL REVENUE SERVICE) requires from people who are getting payments from business. The form is utilized to validate the identity of the private and their address in order to make sure that they are not being paid under a different name.

This form is likewise utilized by companies to track any payments made to professionals and other individuals so that they can meet their tax responsibilities with the IRS.

The IRS W-9 form is a tax form that freelancers will be needed to complete if they are not an employee of the company they are working for. This form is used to report the earnings and taxes kept from them. The W-9 form can be completed online or in hard copy.

Current W 9 Form Irs

Current W 9 Form Irs

Who Requests a W-9 Form?

The W-9 Form must be obtained from you by the person or company who is paying you. The requester is not required to submit the W-9 to the IRS. This individual maintains the form on file and uses the data to generate other returns, including 1099 and 1098 Forms, as well as to determine whether federal tax withholding is required on the payments you receive.

When to ask for a W-9 Form?

For conducting business with independent contractors and freelancers, Form W-9 is necessary. If your company pays small businesses or independent contractors more than $600 per for work that has been completed, you must obtain a W-9.

Current W 9 Form Irs

The payment of Social Security and Medicare taxes by your business is not required, nor is the withholding of income taxes from payments made to independent contractors. The IRS wants to know who you are paying so they can adequately pursue collection. Use your W-9s to report how much you paid each contractor at the end of the year to keep them safely kept.

When a person or business pays another person or business, the IRS frequently uses Form W-9 to collect the relevant data. Working for a company as an independent contractor is one of the most frequent scenarios. You might be required to fill out a W-9 and give it to the company that will be paying you when you start working as a freelancer or contractor for a company.